salt lake county sales tax rate

Estimated Combined Tax Rate 745 Estimated County Tax Rate 135 Estimated City Tax Rate 020 Estimated Special Tax Rate. The December 2020.

A single 500 deposit plus a 35 non-refundable processing fee is required to participate in the Salt Lake County UT Tax Sale.

. Salt Lake in Utah has a tax rate of 685 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Salt Lake totaling 09. The current total local sales tax rate in Salt Lake. 3 rows Salt Lake County.

Sales tax and use tax rate of zip code 84151 is located in salt lake city city salt lake county utah state. The County sales tax rate. To find out the amount of all taxes and fees for your.

22 rows The Salt Lake County Sales Tax is 135. Any property unsold at the Tax Sale and which is not in the public interest to be re-certified to a subsequent sale shall become county property. For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other.

This page lists the various sales use tax rates effective throughout Utah. The amount you need to pay at the time of vehicle registration varies depending on vehicle type fuel type county and other factors. If you are a Utah business owner you can learn more about how to collect and.

The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state nexus laws and sales tax collection requirements. A tax deed will be.

The last rates update has been made on july 2021. According to Sales Tax States 61 of Utahs 255 cities or. Include county local and city taxes.

To review the rules in Utah visit our state-by-state guide. Estimated Combined Tax Rate 745 Estimated County Tax Rate 135 Estimated City Tax Rate 020 Estimated Special Tax Rate 105 and Vendor Discount 00131. Follow this link to view a listing of tax rates effective each quarter.

The minimum combined 2022 sales tax rate for Salt Lake City Utah is. The following sales tax changes were made effective in the respective quarters listed below. Ad Find Out Sales Tax Rates For Free.

Sales and Use Tax Salt Lake City Utah has a 685 sales and use tax for retail sales of tangible personal property and select services which include but are not limited to admissions to. Utah has 340 cities counties and special districts that collect a. The state also collects a special 1635 sales tax specifically on automobile rentals in the Salt Lake City area.

Tax sale property listing will be posted by April 28 2022. A county-wide sales tax rate of 135 is. This includes Utahs state sales tax rate of 4700 Salt Lake Countys sales tax rate of 1350 and Marys local district tax rate of 0800.

UT Sales Tax Rate. Fast Easy Tax Solutions. State Tax Commission Sales Use - 725 745 in Murray and 875 in Alta Restaurant - 825 - 875 975 in Alta Rental Car - 1635 Transient Room Hotel Tax.

West Valley City 685. The value and property type of your home or business property is determined by the Salt Lake County Assessor. Salt Lake City 685.

If you would like information on property. Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. Sales Tax Rates Source.

5 rows The 775 sales tax rate in Salt Lake City consists of 48499 Utah state sales tax. Salt Lake County Sales Tax. The current total local sales tax rate in Salt Lake City UT is 7750.

2 State Sales tax is 485. The Salt Lake County sales tax rate is 135. This is the total of state county and city sales tax rates.

The Utah sales tax rate is currently. The Salt Lake County sales tax rate is 135. 2022 Utah Sales Tax By County.

As far as other cities towns and locations go the place with the highest sales tax rate is Salt Lake City and the place with the lowest sales tax rate is Bingham Canyon.

Sales Taxes In The United States Wikiwand

This Is The Most Expensive State In America According To Data Best Life

California Sales Tax Rates By City County 2022

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Multiutah Property Management 1031 Exchange In Utah Property Management Exchange Wealth Management

Sales Taxes In The United States Wikiwand

Salt Lake City Utah S Sales Tax Rate Is 7 75

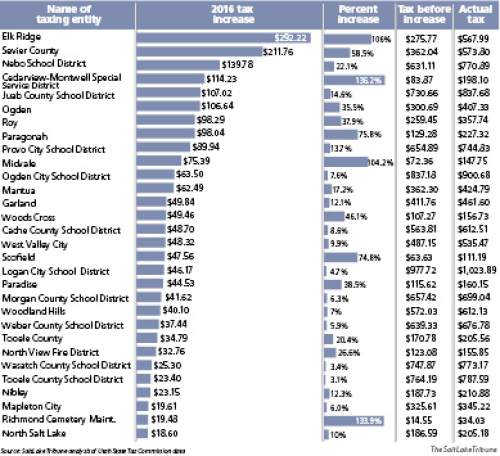

Despite Fuzzy Claims 53 Utah Local Governments Are Proposing Property Tax Hikes The Salt Lake Tribune

Utah Sales Tax Small Business Guide Truic

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Sales Taxes In The United States Wikiwand

Utah Sales Tax Information Sales Tax Rates And Deadlines

The Utah Income Tax Rate Is 4 95 Learn How Much You Will Pay On Your Earnings

Sales Taxes In The United States Wikiwand

Utah S Public Transit System Went From Being Reviled To Celebrated In 2006 Voters Easily Approved A Quarter Cent Sales Tax Hike So Transit Map Utah Turn Ons

Currently Renting Call Me Today To Find Out What Your Monthly Payment Can Buy Dustin Salt Lake S Favorite Home Buying Finance Plan Paying Off Mortgage Faster

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy